How US tax hike could impact Bangladesh’s economy

To raise taxes on multinationals and foreign affiliates, the U.S. has completed a historic foreign tax rewrite in the last few years, but the final product in many ways is quite different from its original authors’ intent. Although the move is meant to target big companies and tackle tax avoidance, the ripples are expected to hit developing economies such as Bangladesh. Bangladesh is affected directly and indirectly by the U.S. tax hike given its expanding export sector, rising foreign direct investment (FDI), and dependence on remittances of workers abroad.

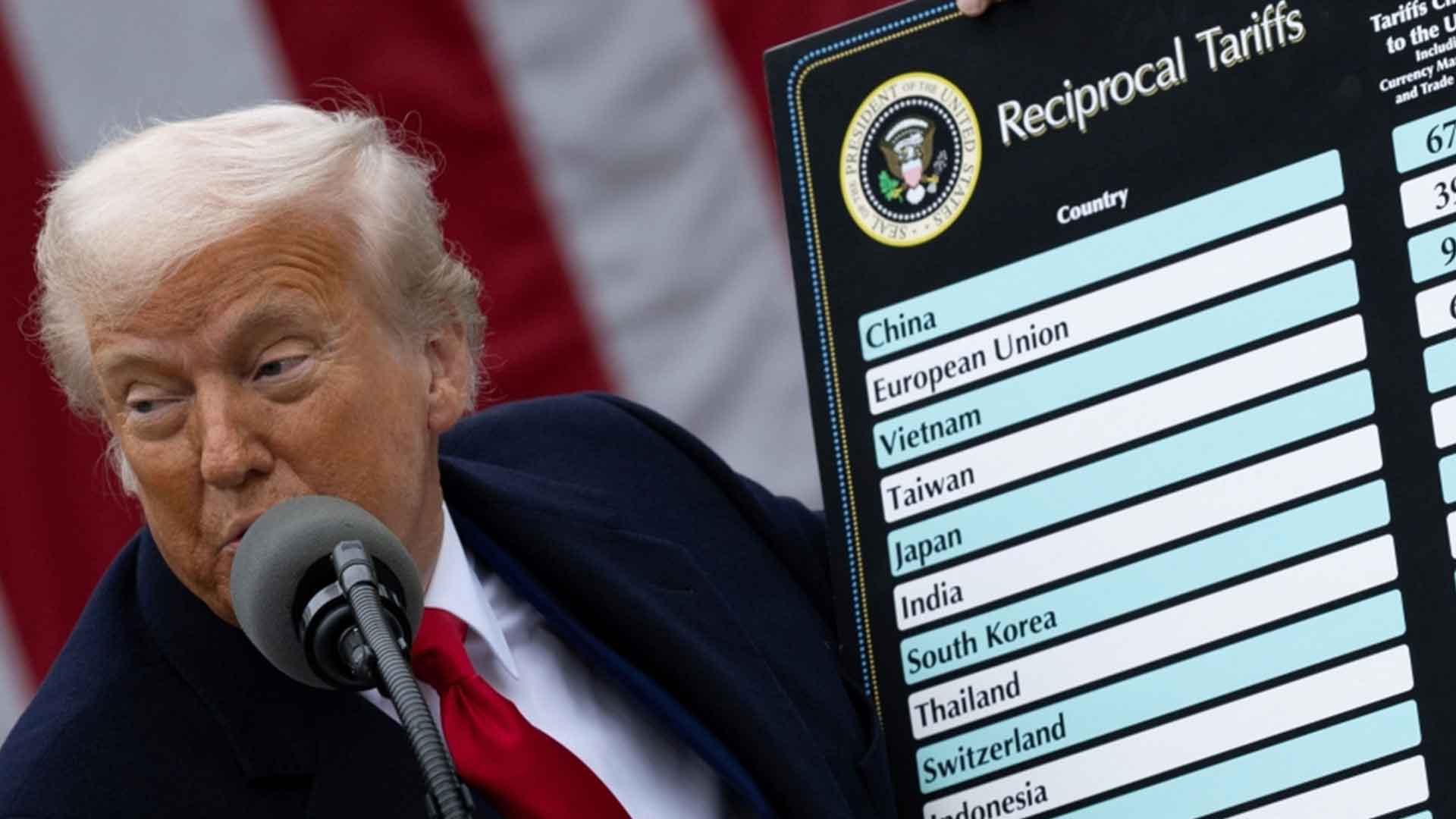

The U.S. Foreign Tax Hike Explained

In the U.S., Global Intangible Low-Taxed Income (GILTI), Subpart F income, and foreign tax credits have been subject to tighter rules. These changes mean U.S.-based companies doing business abroad or those whose factories for goods or providers of services are in countries such as Bangladesh could be facing a higher effective tax rate when it comes to bringing home profits or to foreign subsidiaries. The goal is to stop profit-shifting and generate more tax revenue from global operations.

Possible Effects on Bangladesh

Export Sector Under Pressure:

The United States is among the top importers of Bangladeshi commodities, especially Ready-made Garments (RMG). If American companies try to reduce costs by moving production elsewhere, then they will cope with a higher tax burden on U.S. license or-level importers. That could make Bangladesh a less favourable location for a low-cost global manufacturing hub. This could lead to:

Slashed orders from American brands, especially in price-sensitive sectors.

Shifts in supply chains to other countries that have either trade agreements or tax benefits that outweigh the increase in U.S. tax.

More pressure on prices which would force Bangladeshi manufacturers to bear costs with an impact on profit margins and potentially job losses.

May Gradually Slow Foreign Direct Investment:

Bangladesh is in US company a growing interest in investment in the energy, telecom, and IT sectors of the US. But if a country has a higher tax rate on foreign earnings, multinational firms may reduce their expansion in Bangladesh or move to countries with generous tax treaties or tax breaks. This could:

Limit technology transfers and capital floods.

Postponed infrastructure or service sector developments tied to U.S. FDI.

Undermine Bangladesh’s desire to be a middle-income digital economy.

Impact on Remittances:

The U.S. is home to a sizable Ghanian diaspora that sends home billions of dollars in remittances per year. Although personal remittances are not directly taxed under the new corporate regime, the stricter tax enforcement and scrutiny of cross-border transactions may discourage informal money transfers, raising transaction costs. The consequences may include:

Experience lower remittance volume due to lower disposable income or increased cost.

Exchange rate and foreign reserves pressure in case of substantial remittances drop.

The Change of Global Trade Dynamics:

For decades, Bangladesh’s economic model has relied on being a low-cost producer. The U.S. tax shifts could push more companies toward this global repositioning, in which they focus operations in fewer, wealthier regions to limit their tax exposure. With no solid bilateral trade deals or tax treaties with the U.S., Bangladesh risks being left behind unless it lowers its guard quickly.

Key Takeaways and Policy Recommendations for Bangladesh

To mitigate the adverse effects, Bangladesh should:

Negotiation of double taxation avoidance agreement (DTAA) or amendment of existing ones with the U.S.APPLICATION OF TAX TREATY:

Export to EU, Japan, and Middle East as an alternative for U.

Automation, upskilling and reskilling, and upgrading infrastructure to improve competitiveness.

Providing tax breaks or rebates to U.S. companies investing in Bangladesh.

Using economic diplomacy to protect exporters and workers abroad.

Conclusion:

The foreign tax hike in America is intended to rein in tax avoidance in the corporate sector but could deter those very countries like Bangladesh from an economic trajectory. For an economy heavily reliant on exports, remittances, and foreign investment, initiative-taking engagement, policy innovation, and diversification will be essential for weathering the storm. The next few months will be critical in deciding if this challenge can be transformed into an opportunity that leads to more resilient and diversified growth for Bangladesh.